New Incentive Decree On The Investments Of Critical Sectors In Turkey (2014)

Ali CAKMAKCI

F. Tax Inspector, Sworn in CPA, Independent Auditor

cakmakciali@adenymm.com.tr

1-Introduction:

We have arranged this article for you to explain investment opportunities in Turkey, some special lucrative sectors and state incentives on investments. As you know, Turkish government had a new incentive decree on the investments that have critic importance recently (June 2012). The New Investment Incentive System of Turkey, which was introduced in April 2012, has been enacted since June 15, 2012 with the Decree no. 2012/3305. The procedures about the Decree was detailed in the Regulation no. (2012/1.)

With these new arrangements, the government expects the Turkish economy to be tent biggest economy in the world by 2023 prospect, the income per person to be 25.000-USD by 2023 and the Turkey’s export to be 500 billion USD in value by 2023 as a macro goals. The New Investment Incentive Program that is vital for Turkey’s 2023 vision as well as for the production and export-oriented growth strategy aims to steer savings into high value added investments, boost production and employment, encourage large scale and strategic investments for increased international competitiveness, increase foreign direct investments, reduce regional development disparities, promote investments for clustering and environment protection in line with the objectives set in development plans and annual programs. Supports provided by this new Investment Incentive Program will be available for all investments with an incentive certificate granted after January 1, 2012.

The new investment incentive decree is specifically designed to encourage investments with the potential to reduce dependency on the importation of intermediate goods vital to the country’s strategic sectors. In order to further accelerate investment decisions, the new investment incentives system grants more advantageous supports for investments to be initiated by the end of 2013. Spending at least 10 percent of the investment amount will suffice for the investment to be considered as started.

As you know, devoloping countries like Turkey have a deficient in production amount, and this deficiency causes an employment deficient, and this deficiency causes a deficient in saving amount for investments to grow the economy up and similarly this deficiency causes an investment deficient and investment deficiency submits you a production deficient.

So that you must break this vicious circle with internal investment programmes like that we mention here:

We could count expectations from the government’s decree as the production rise, new employment rise, luring on direct foreign investments for Turkey, increasing the competition, fostering stratejik invesments, closing development disparity of the regions of Turkey’s in micro goals.

The govermental decree separate Turkey’s cities into six diffrent regions because of their sosyo-economic developed or undeveloped situation and other sosyo-economic conditions.

2-Upon On Some Spesific Sectors In Turkey:

We give you the most important and lucrative investment sectors nowadays in the prospect of the decree in below. Of course, The investment incentives in the decree mentioned in this article dosen’t consist of only those sectors. So that, at first we must look at the priority sectors that are given vey high importance by the state because of social benefits for Turkish nation and economy:

1-Fair Investments: This sector aren’t developed adequately and indicated as a very profitable sector. There aren’t many companies in the sector, so that this is a change for investors to lure the foreigner businessmen to Turkey.

2-Education Investments: As you know, Turkish population is very young and needs very high school investments to close the deficiency in education. Private education sector is developing everyday and gives you minimum a %20-%25 profit marjin as generally (changeable according to regions).

You don’t give coorperate or income tax to the state because in our tax system you are exempted from taxes for five (5) years in the operating times of your business. This sector is expected to grow more than 2 times in a few years time.

This sector is indicated in the preority investment area so that in whichever region you do your investment there is no problem to utilize state incentives. And, in whichever region you install your business you get the most intensificated state support financially because this sector investments benefit from 5. region supports (if you do your business in 6. region, then you will benefit from 6. regional supports financially), so that with a education investment (colleage, secondary school, elemantary scholl etc) you utilize the undeveloped cities’ ample incentive supports.

Addionally, there are lots of exemptions for education investments especially in VAT law and other fiscal laws. As we’ll indicate at below, state give your business support of minimum at the rate of %27, maximum at the rate of %116. So that you get return of your investment in short term.

But, it needs minimum 1.000.000-TL investment amount in the first and second regions and 500.000-TL investment amount in the other regions.

3-Hospital Investments: Owing to social benefits of health, hospital investments are one of the most popular investment areas in Turkey. İn our country our system encourages investors to start a investment plan as soon as possibble. İf you do an investment in hospital sector you benefit from the regional investment opportunities and get a investment return with state support.

As we’ll indicate at below, state give your business support of minimum at the rate of %27, maximum at the rate of %116. So that you get return of your investment in the short term. But, it needs minimum 1.000.000-TL investment amount in the first and second regions and 500.000-TL investment amount in the other regions.

4-Agriculture Investments: Agriculture investments aren’t sufficient in Turkey. Especially, in milk operating facility investments and chicken investments are the most popular sectors nowadays.

You could get a maksimum 500.000-Euro European Union support and other state incentives with this investment. There isn’t much big-scales companies so that they can’t utilize from scale economies.

5-Rafinery Sector: Among the sectors especially “rafinery sector” is the most lucrative or profitable sector in Turkey owing to having only one rafinery company named Tüpraş and there is no rivalry in this sector. The profits of the comapany’s are high according to general economic conditions and the company had a 41.300.000.000-TL endorsement in 2011 and had a nearly 1.500.000.000-TL profit before coorperate tax. Tüpraş is the market leader for now.

3-Who Can Benefit From Investment Incentives?

1-Real persons, ordinary partnerships, stock corporations, cooperatives, joint ventures,

2-Public institutions and agencies,

3-Public professional organizations,

4-Associations and foundations,

5-Turkish branches of foreign based companies

can benefit from supports extended under the Investment Incentives Program of Turkey provided that they satisfy all criteria set for each scheme.

As of Law No. 4875 on Foreign Direct Investments, companies established in Turkey by real persons of foreign nationality and/or by legal persons according to the laws of foreign countries are eligible for benefiting from all supports within the scope of the Investment Incentive Decree under equal conditions with domestic investors, as they are also classified as Turkish companies. Thus, these companies are considered as stock corporations and supported by the Investment Incentives Program. “Branches”, without company status, founded in Turkey in accordance with the Turkish Commercial Law by foreign companies based in other countries can also benefit from these supports.

Incentive schemes granted by the new program can be applied by a real person of foreign nationality through a joint-stock or limited liability company, and by a foreign company based in foreign countries through a joint-stock, limited liability company or a branch established in Turkey.

4-How Can You Apply For The Incentives:

Investors must apply officially to receive the supports provided within the scope of the Investment Incentives Program. Before applying officially, in line with certain principles and procedures, they can consult the Ministry of Economy, Directorate of Incentive Implementation and Foreign Investment to seek information on the scheme their projects fit in or investors can determine their scheme by studying the incentives communiqué. Before applying, investors should also check investment subjects not supported or conditionally supported. Investors should be well informed about their projects in terms of the following aspects in order to run through the process efficiently:

1-Place of investment designated for the project or alternative investment places,

2-Industry of the investment project,

3-Subject, capacity and approximate investment amount of the project,

4-For the strategic investments, domestic production capacity and import data of the product to be produced.

5-The Kinds Of Incevtives:

The investment supports or incentives of Turkey’s can be said in 4 formal structures:

1-General Incentive Programme:

The General investment incentives apply to all investments in Turkey and irrespective of the sector or region invested in, provided that they are not exempted by the Council of Ministers and fall within the boundary of the minimum fixed investment amount, which is 1.000.000-TL in regions 1 and 2 and 500.000-TL in regions 3 – 6. As we said, this programme mainly needs minimum a-1.000.000-TL in value investment amount for developed cities like İstanbul, Ankara, Bursa, Eskişehir etc. as difened the first and second regions in the decree (As we said at upper section this system separate cities into six region and first and second regions are the most developed cities generally) and/or again minimum a-500.000-TL in value investment amount in the other regions.

The general investment incentive programme needs a investment incentive docement being got from Economy Ministry Of Turkey’s. You must complete the investment on time as defined in the document. And, basically this document may be given to every investor that wants to enter a spesific investment as generally.

The programme insure investors in Turkey in terms of:

1-Costom Taxes Exemption,

2-VAT Exemption.

3-İncome Tax Exemption (Only for sixth region investmens)

4-Employer İnsurance Support (Only for shipyard investments)

2-Regional Investment Programme:

This programme divide Turkey’s cities into six region and gives very high opportunity to the investors to invest on profitable but unexperinced sectors. The newly tailored incentive map of Turkey is now divided into regions by their levels of potential, economy and development. Also, the New Program’s map is city-based rather than categorized by the names of the regions, as was the situation under previous program’s incentive map. We give you the cities in which region they are and regional investment map that influences your incentives or state contributions at below:

This programme gives you lots of investment opportunities due to provide your investment with state fiscal support or contribution. We could say the avdantages of the programme like that:

1-Costom Taxes Exemption,

2-VAT Exemption-Refund,

3-Investment Support (Contribution) With Reducing Coorparate Tax Rates.

4-Employer Insurance Exemption,

5-İnvestment Land Utilize Rightes For 49 years (State gives you the appropriate lands for your investmens),

6-İnterest Support (1. and 2. regions exempt from this opportunity) (State gives you interest support İf you use TL or foreign exchanges bank loan in your investment)

7-İncome Tax Support (Only for sixth region investments),

8-Employer Insurance Support (Only for sixth region investments)

3-High Scale Investment Programme:

Large scale investments form a separate category with applicable incentives. It should firstly be noted that the minimum fixed investment amount is reassessed. The amount has decreased for certain investment categories. İf you enter a new investment areas that additonal to decree in the 3. list, you get a high scale state support that returns your investment’s financial feedbacks very quickly. But, there is no support in loan interest rates in comparasion with the other programmes mentioned before.

| No | Investment Subjects | Mınımum Investment Amount (Mıllıon TL) |

| 1 | Refined Petroleum Products | 1.000 |

| 2 | Chemical Products | 200 |

| 3 | Harbors and Harbor Services | 200 |

| 4 4-a 4-b | Automotive OEM and Side Suppliers Automotive OEM Investments Automotive Side Suppliers Investments | 200 50 |

| 5 | Railway and Tram Locomotives and/or Railway Cars | 50 |

| 6 | Transit Pipe Line Transportation Services | 50 |

| 7 | Electronics | 50 |

| 8 | Medical, High Precision and Optical Equipment | 50 |

| 9 | Pharmaceuticals | 50 |

| 10 | Aircraft and Space Vehicles and/or Parts | 50 |

| 11 | Machinery (including Electrical Machines And Equipment) | 50 |

| 12 | Integrated Metal Production | 50 |

According to programme, there is no compulsory to invest in a spesific region. You are independent from region criteria and you must produce something in the sectors that additional to the decree. This programme needs minimum 50-milyon TL in value investment amount. There are 12 spesific sectors like rafinery sector that needs minimum a-1.000.000.000 TL investment amount, port or port services productions, medicine production, air or space vehicles production, chemicial productions in the programme.

We could say the advantages of the programme to the investors like that:

1-Costom Taxes Exemption,

2-VAT Exemption,

3-Investment Support With Reducing Coorparate Tax Rates.

4-Employer Insurance Exemption,

5-İnvestment Land Utilize Rightes For 49 years (State gives you the appropriate lands for your investmens),

6-Income Tax Support (Only for sixth region investments).

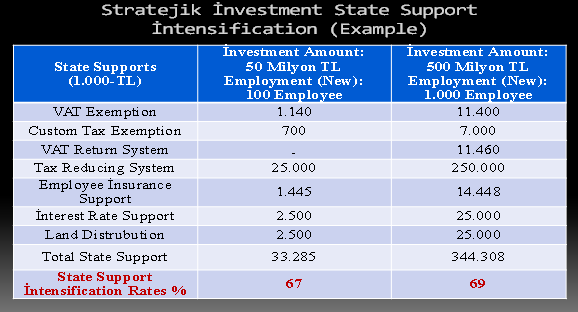

4-Strategic Investment Programme:

Stratejik investment is the investment that highly dependent on importation and focuses on the product internal production amount is less than importation. This investment dosen’t require regional investment criteria, but reqiures minimum 50-milyon TL investment amount and minimum %40 producing phase in Turkey after investment. An investment is regarded as strategic if it is made for the production of intermediate or final products of which more than 50% is supplied by imports, or if they are energy investments that are made for the exclusive use of such investments. Further criteria for such investments are that they should:

1-Have a minimum investment amount of TL 50 Million,

2-Create a minimum of 40% added value (This condition is not applicable to refined petroleum production investments and petrochemicals production investments),

3-Have an import amount of at least USD 50 Million for goods to be produced in the last one year term (the latter criterion does not apply to goods that do not have domestic production). A commission in Economy Ministry will decide which investment strategic or not. We could say the avdantages of the programme to the investors like that:

1-Costom Taxes Exemption,

2-VAT Exemption-Refund,

3-Investment Support With Reducing Coorparate Tax Rates,

4-Employer Insurance Exemption,

5-Investment Land Utilize Rightes For 49 years (State gives you the appropriate lands for your investmens),

6-Income Tax Support (Only for sixth region investments).

7-Interest Rates Supports,

8-VAT Return System,

9-Employee Insurance Support.

1] Mesleki çalışmalarımızda yer alan bilgiler belli bir konunun veya yasal düzenlemenin veyahut yargı kararlarının çok geniş ve kapsamlı bir şekilde ele alınmasından ziyade genel olarak mükelleflere ve uygulayıcılara bilgi vermek, gündemi talip etmeye yardımcı olmak ve yorum yapmalarına yardım amacını taşımaktadır.

Makaleleri yazıldığı dönem ve yasal düzenlemelerin dikkate alınarak değerlendirme yapılmasının önemli olduğunu hatırlatmak isteriz. Makalelerin telif ve diğer yasal hakları doğrudan şirkete ve yazarına ait olup, atıf yapmadan veya izinsiz kullananlar hakkında her türlü yasal işlemin yapılacağını ifade ederiz.

Çalışmalarımız profesyonel hizmetlerimizi temsil etmeyebileceği gibi, her durum ve koşulda profesyonel yaklaşımlarımızı da ifade ettiği iddia edilemez. Yaptığınız fiili/pratik çalışmalarda bu değerlendirmeler dikkate alınırken, olayların koşullarının da incelenmesi, irdelenmesi, sonuçlarının iyi analizi son derece önemlidir. Bu tür çalışmalarda mutlak suretle bir profesyonelden bilgi alınması veya danışmanlık alınmasında fayda bulunduğu düşünülmektedir. Şirketimiz tarafından iş ortalarımızın personellerimizin yetişmesi ve gelişmesinden duyduğumuz sorumluluğu yerine getirme gayreti içinde olacağımıza dair sözümüzü tutma gayreti içinde olduğumuzu iletmek isteriz.

“ADEN Yeminli Mali Müşavirlik Bağımsız Denetim ", söz konusu çalışmaların ve içeriğindeki bilgilerin özel durum veya koşullara bağlı olarak hata içermediğine dair herhangi bir güvence vermemektedir. Mesleki çalışmaları ve içeriğindeki bilgileri kullanımınız sonucunda ortaya çıkabilecek her türlü risk tarafınıza aittir ve bu kullanımdan kaynaklanan her türlü zarara dair risk ve sorumluluk tamamen tarafınızca üstlenildiğinin bilinmesi gerekmektedir.